- Home

- content hub

- How to Calculate Marketing ROI and Prove Your Value

How to Calculate Marketing ROI and Prove Your Value

Emma Davis

Content Writer

Oct 19, 2025317 views

Oct 19, 2025317 views

Calculating your marketing ROI boils down to a pretty simple formula. You just take the sales growth your marketing generated, subtract what you spent on that marketing, divide the result by your total marketing cost, and then multiply by 100.

What you get is a percentage that cuts through the noise and tells you exactly how much you earned for every dollar you put in. It turns all your hard work into a clear, undeniable measure of profitability.

What Marketing ROI Actually Tells You

Before we get tangled up in formulas, let’s get clear on what marketing ROI really is. It’s so much more than a number on a spreadsheet. In my experience, it’s the single most powerful metric for proving your team’s value and defending your budget.

Think of it this way: ROI tells the story of how your marketing efforts directly fuel business growth. It’s the thread connecting every dollar you spend to a real, tangible outcome.

Simply tracking revenue alone isn’t enough because it conveniently ignores how much it cost you to bring that money in. ROI adds that critical context. For instance, a campaign that pulls in $10,000 in revenue might look like a huge win at first glance. But if it cost you $12,000 to run, you've actually lost money. Ouch.

The Foundational Formula

At its heart, the Marketing ROI formula is refreshingly straightforward: ((Sales Growth - Marketing Cost) / Marketing Cost) x 100. This calculation spits out a percentage that shows your return relative to what you invested.

Let's say you spent $250 on a campaign that brought in $500 in new sales. Your ROI would be 100%. Simple, right? You doubled your money. While the math itself is easy, the real challenge I see people face is accurately tracking every single cost and correctly attributing revenue back to the right campaign.

Key Takeaway: A positive ROI proves your marketing department is a profit center, not a cost center. It completely changes the conversation from "how much did we spend?" to "how much did we earn?"

Grasping this fundamental concept is the first step toward smarter, more strategic planning. It’s what helps you answer the questions that really matter:

- Which of our channels are actually making us money?

- Where should we put our budget next quarter to get the biggest bang for our buck?

- Are our campaigns better at building long-term brand awareness or driving sales right now?

If you want to go deeper into the whole process and explore different ways to approach it, there's a fantastic guide on how to measure marketing ROI that breaks everything down.

Getting the Right Data for an Accurate Calculation

Your marketing ROI calculation is only as good as the data you feed it. Seriously. Get the inputs wrong, and the output is meaningless.

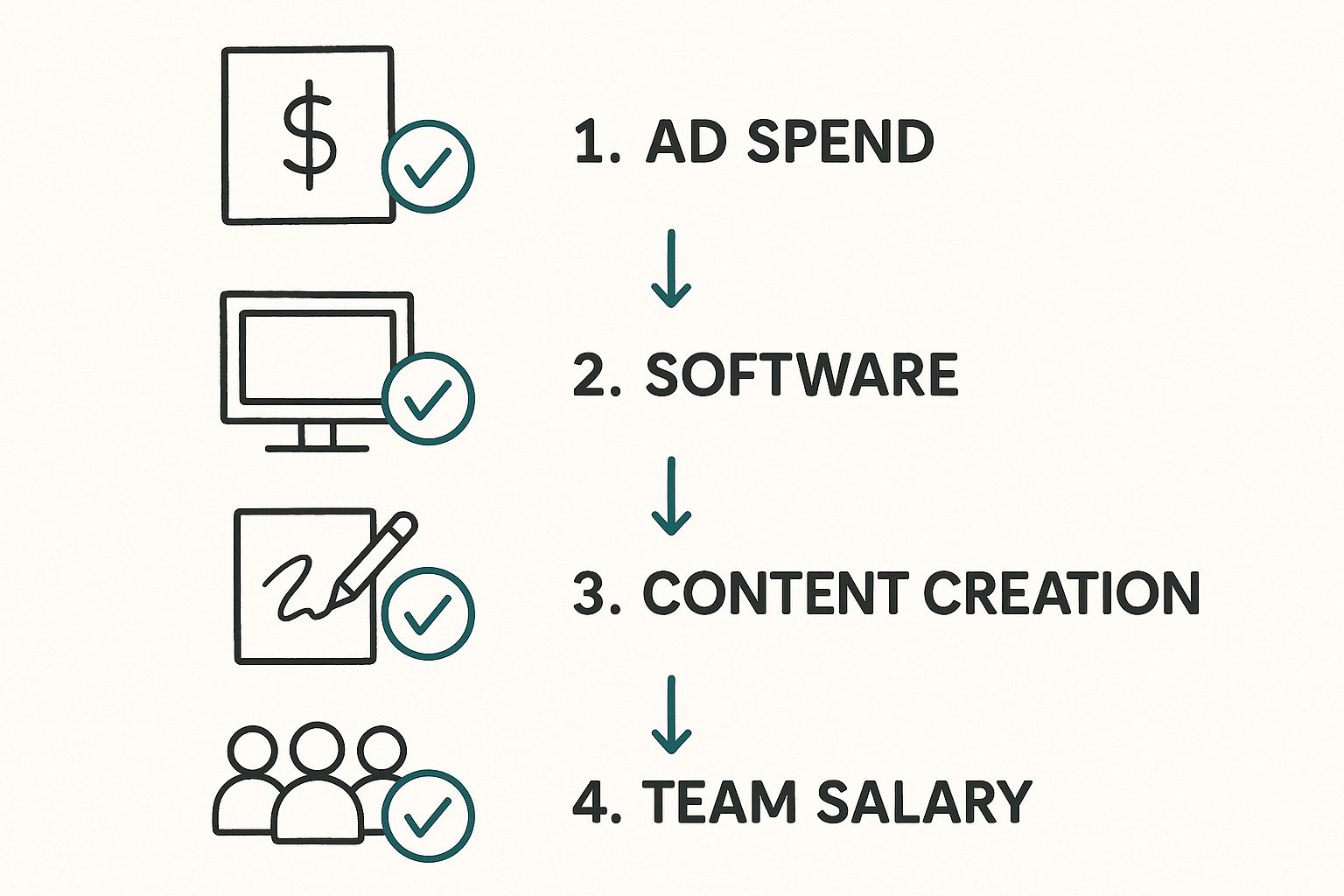

An accurate result boils down to tracking two things really, really well: your total marketing investment and the sales growth you can attribute to it. So many marketers make the mistake of only counting the obvious costs, like ad spend. That will always give you an inflated, misleading ROI.

To get the real picture, you have to account for every single penny. This isn't just about your direct ad spend. It includes software subscriptions for your CRM or email platform, content creation costs, and any agency or freelancer fees. You should even factor in a portion of your marketing team’s salaries to the investment side of the equation.

This process highlights a crucial point: a complete cost analysis goes way beyond surface-level expenses to include operational and human capital costs. By ticking off each category, you ensure your "investment" figure is rock-solid.

Essential Data Inputs for ROI Calculation

To really nail this down, you need a clear list of what to track. Here’s a breakdown of the cost and revenue data points you’ll need to pull together for a truly accurate marketing ROI calculation.

| Data Category | Specific Examples | Tracking Method |

|---|---|---|

| Direct Campaign Costs | Ad spend (PPC, social), media buys | Ad platform dashboards (Google Ads, Meta Ads) |

| Content & Creative | Freelance writers, designers, video production | Invoicing software, project management tools |

| Marketing Technology | CRM, email marketing platform, analytics tools | Subscription receipts, accounting software |

| Team & Overhead | Salaries (pro-rated), agency retainers | Payroll records, agency contracts |

| Sales Revenue | New customer sales, upsells, renewals | CRM reports, e-commerce platform analytics |

| Lead Generation | MQLs, SQLs, demo requests with values | Marketing automation platform, CRM reporting |

Gathering this data upfront saves a ton of headaches later. It transforms your ROI from a rough guess into a reliable metric you can confidently present to your team or leadership.

Pinpointing Your Attributable Revenue

Now for the other side of the coin: revenue. The big challenge here is attribution. How can you confidently say a specific campaign drove a particular sale? This is where diligent, almost obsessive, tracking becomes non-negotiable.

Pro Tip: If you take one thing away from this, let it be this: establish clean, consistent data tracking habits from day one. It’s so much easier to maintain good habits than it is to clean up a mountain of messy data months from now. This discipline is what separates guessing from knowing what truly drives results.

Here are a few essential methods I always recommend for tracking revenue back to your marketing efforts:

- UTM Parameters: These are your best friends. Use these little tags on all your campaign URLs to see exactly where your traffic and conversions are coming from in your analytics platform. No excuses.

- CRM Reporting: Your CRM is a goldmine, but only if you use it right. Make sure sales reps are logging the lead source for every single new opportunity. This is how you connect marketing touches directly to closed deals.

- Dedicated Landing Pages: This one is simple but effective. Create unique landing pages for different campaigns, like your direct mail services, to completely isolate conversions and measure that channel's performance accurately.

By putting these tracking methods in place, you create a clear line of sight from your marketing activities straight to your bottom line. That makes your ROI calculation both defensible and genuinely insightful.

Picking the Right ROI Formula for Your Campaign

The basic revenue-based ROI formula is a fantastic place to start, but let's be honest—it doesn't paint the whole picture. There’s no single, perfect way to calculate marketing ROI. The best model really depends on what you're trying to accomplish with a specific campaign.

For instance, if you sell physical products, just looking at revenue can be incredibly misleading. It completely ignores what it cost you to make those items in the first place. You could have a campaign that brings in a ton of revenue but operates on such a razor-thin profit margin that your actual return is tiny. This is exactly why we need to dig a little deeper.

Get a Truer Picture with Gross Profit

A much more accurate way to see how profitable a campaign really is involves using Gross Profit ROI. This formula factors in your Cost of Goods Sold (COGS), giving you a much clearer view of the real profit your marketing dollars are generating.

The formula is simple: (Gross Profit – Marketing Investment) / Marketing Investment

Let's walk through a real-world example. Imagine you run a campaign for custom t-shirts that pulls in $80,000 in sales. Your COGS—which includes the blank shirts, the ink, and the labor—totals $40,000. That leaves you with a gross profit of $40,000. If you spent $10,000 on the marketing for this campaign, here's how the math shakes out:

- ($40,000 - $10,000) / $10,000 = 3.0 or 300% ROI

What this tells you is that for every $1 you spent on marketing, you generated $4 back in gross profit. For anyone selling physical or even digital products, getting a handle on this calculation is one of the most important marketing essentials you can master.

Measure Long-Term Health with LTV to CAC

Another powerful metric, especially if you're in a subscription-based business or rely heavily on repeat customers, is the Lifetime Value (LTV) to Customer Acquisition Cost (CAC) ratio. This isn't a direct campaign ROI formula in the traditional sense, but it’s a crucial measure of your long-term marketing efficiency and overall business sustainability.

It pits the total value a customer will bring you over their entire relationship with your business against what it cost you to get them in the door. A healthy ratio proves your marketing isn't just winning a single sale—it's building profitable, long-term relationships.

For example, if your average LTV is $2,000 and your CAC is $500, your LTV:CAC ratio is 4:1. That’s a strong signal that your marketing is working very efficiently. These different formulas help you move beyond just tracking revenue and start to truly understand—and prove—the financial impact of your marketing efforts.

Measuring ROI in B2B and Complex Sales Cycles

Calculating marketing ROI for a quick e-commerce purchase is one thing. But what about a B2B company with a six-month sales cycle? Good luck with that. The path from a prospect’s first blog visit to a signed contract is long and winding, making simple, last-click attribution feel almost dishonest. A future customer might interact with a dozen touchpoints over several quarters—blog posts, webinars, sales calls, you name it.

This complexity forces a shift in perspective. Instead of obsessing over which single touchpoint "got the sale," we need to zoom out and look at the entire journey. When you’re dealing with a modern sales funnel B2B guide, you have to assign value to each stage, not just the finish line.

Leveraging Customer Lifetime Value (CLV)

In these long-game scenarios, Customer Lifetime Value (CLV) is your best friend. It moves the focus from a single transaction to the total revenue a customer will bring in over their entire relationship with your company. This is an absolute game-changer for SaaS or service-based businesses where long-term retention is the name of the game.

Here's a B2B-centric formula I've seen work wonders: (CLV × New Customers - Marketing Investment) / Marketing Investment. This approach helps justify higher upfront costs for activities like in-depth lead generation and nurturing, since the real payoff comes over months or even years, not days. It completely changes the conversation from "did this ad make a sale?" to "how is marketing building sustainable, high-value customer relationships?"

Key Takeaway: For long sales cycles, measuring influence is far more practical than measuring direct attribution. The goal is to see how marketing contributes to pipeline velocity and deal size, not just which ad someone clicked last.

Many B2B marketers I know aim for a benchmark revenue-to-spend ratio of around 5:1. This means for every $1 you put in, you’re aiming to get $5 back in revenue. Of course, this can swing wildly depending on the industry and average deal size. By adopting models like this, you can paint a much more accurate picture of your marketing's long-term impact on the bottom line.

Turning Your ROI Numbers into Actionable Insights

Alright, you've done the math and have your ROI number. Great. But that's only half the story. A raw percentage doesn't tell you what to do next—the real magic happens when you turn that data into smarter marketing decisions.

So, what’s a “good” ROI, anyway? People love to throw around 5:1 (a 500% return) as a solid benchmark, but honestly, it completely depends on your business.

A B2B SaaS company with a year-long sales cycle might be popping champagne over a 3:1 return, because they know the customer lifetime value will make that incredibly profitable down the road. On the flip side, a high-volume e-commerce store with razor-thin margins might need to see 7:1 just to keep the lights on. Context is everything.

Break It Down by Channel

To get truly useful insights, you have to stop looking at one big, blended ROI number. A total ROI of 400% might look healthy, but it could be masking an incredible 800% ROI from your Google Ads campaigns and a dismal 50% ROI from that new social media experiment you’re running.

When you start slicing the data by channel, you can finally see what’s really working.

- Paid Search (PPC): This is often a quick win. You’re catching people with high intent, so the ROI is usually strong and immediate.

- Content Marketing & SEO: This is the long game. The initial ROI can feel painfully low, but it compounds over time as your organic traffic snowballs.

- Email Marketing: Almost always a top performer. With a low cost and a direct line to a warm audience, email marketing is known for its stellar ROI.

- Paid Social: This one can be all over the place. It's fantastic for building brand awareness at the top of the funnel, but its direct sales ROI often lags behind search ads.

Once you have this channel-specific data, you can start optimizing your budget. The goal is simple: systematically shift your ad spend from the channels that are dragging you down to the ones that are proven winners.

This isn't just about cutting costs; it's about reallocating every dollar to make it work as hard as possible for you. When you bring these findings to your boss or client, you're not just presenting numbers. You're showing them a clear, data-backed strategy for driving more profit.

Common Questions About Calculating Marketing ROI

Even with the right formulas, things can get murky when you're trying to calculate marketing ROI. Some campaigns, especially the ones built for long-term brand awareness, don't have a straight line to a sale. That makes pinning down their value a real challenge.

Let's dig into some of the most common questions that pop up when marketers get down to the numbers.

How Do You Measure ROI for Brand Awareness?

Brand awareness campaigns are a classic ROI headache. You're not trying to get someone to click "buy" right away, so how do you prove the money was well spent? Instead of looking for direct revenue, you have to lean on proxy metrics—these are indicators that show your brand's influence and visibility are on the rise.

Think of these metrics as stand-ins for sales that demonstrate you're building momentum. If your goal is to grab more mindshare, start tracking these key performance indicators:

- Share of Voice (SOV): How much of the conversation in your market do you own compared to your competitors? A jump in SOV is a great sign that your campaign is cutting through the noise.

- Branded Search Volume: Are more people typing your brand name directly into Google? This is a huge win. It's a powerful signal that people remember you and are actively looking for you.

- Direct Website Traffic: An increase in visitors who type your URL straight into their browser means they know exactly who you are. No search engine needed.

While you won't get a clean ROI percentage from these, they provide compelling evidence that your investment is building a valuable long-term asset: a memorable brand.

What Are the Biggest Mistakes Marketers Make?

It’s easy to fall into a few common traps that can completely throw off your ROI calculations. Just being aware of them is the first step toward getting numbers you can actually trust.

The most common slip-up is incomplete cost tracking. It happens all the time. Marketers tally up their direct ad spend but forget to include the cost of producing the creative, the software subscriptions they used, or even the slice of their team's salary that went into the project. This makes the ROI look artificially high.

Another big one is poor attribution. If you don't have a solid system with UTM parameters and CRM data, it’s almost impossible to know which touchpoint truly deserves credit for a sale. This leads to funneling future budgets into the wrong channels based on flawed data.

How Often Should You Calculate ROI?

There's no single right answer here. The best cadence for calculating ROI depends entirely on the campaign's length and goals.

- For short-term campaigns, like paid ads, you should be checking in on ROI weekly, if not more often. The data comes in fast, letting you make quick pivots to optimize performance. This is especially true for any paid advertising where you can adjust budgets on the fly.

- For long-haul strategies like content marketing or SEO, a quarterly review makes much more sense. These efforts take time to gain traction, and checking in too frequently can be discouraging and misleading.

By matching your reporting schedule to the nature of the campaign, you’ll get a far more accurate and actionable picture of what’s really working.

Ready to make your marketing tangible? At 4OVER4, we offer a huge selection of high-quality printing services to bring your campaigns to life and drive measurable results. https://4over4.com

More from how to calculate marketing roi

10

When you hear "table tent specs," what we're really talking about are the foundational details for printing them correctly: the

Emma Davis

Emma Davis

Jan 27, 2026

61

When you're ready to print a poster, one of the first questions you'll face is, "What size should it be?" The industry has a

Emma Davis

Emma Davis

Jan 26, 2026

88

Picture this: you're at a networking event, and someone hands you their business card. You do the usual glance—name, title, company—an

Emma Davis

Emma Davis

Jan 25, 2026

104

Believe it or not, figuring out how to make a card in Word is surprisingly easy. You can knock out everything from slick, professional busines

Emma Davis

Emma Davis

Jan 24, 2026

104

Printing on packaging takes a simple container and turns it into one of your most powerful marketing tools. It’s the very first physical int

Emma Davis

Emma Davis

Jan 23, 2026

326

When you're getting ready to print a flyer, one of the first questions you'll face is, "What size should it be?" The most co

Emma Davis

Emma Davis

Jan 22, 2026

332

How Our Free Business Cards Program Works (Quick Overview) Free business cards are available through two different

Emma Davis

Emma Davis

Jan 22, 2026

179

A QR code business card does more than just share your name and number; it cleverly merges your physical card with your digit

Emma Davis

Emma Davis

Jan 21, 2026