- Home

- content hub

- A Practical Small Business Marketing Budget Guide

A Practical Small Business Marketing Budget Guide

Emma Davis

Content Writer

Oct 22, 2025576 views

Oct 22, 2025576 views

Determining a marketing budget for your small business can feel like a shot in the dark. A good rule of thumb is to set aside 7-10% of your annual revenue. For a brand new startup, this might only be $200-$500 a month. For a more established business, that number could easily climb to $10,000 monthly to keep the growth engine running.

Why Your Business Needs a Strategic Marketing Budget

Let's be real—saying you "need a budget" is obvious. The real conversation is about why. Flying blind with your marketing spend is a surefire way to waste money on ads that don't work, stall your growth, and end up with a brand message that no one hears.

A well-planned budget isn’t about pinching pennies. It's about empowering your business to make smart, intentional moves. It’s the tool that lets you compete with the big guys, attract customers who actually buy, and build something that lasts. Even when cash is tight, a strategic budget is your foundation for every win.

From Guesswork to Growth

Without a plan, your marketing decisions become reactive. You boost a social media post that got a few likes or print some flyers on a whim. These things feel productive in the moment, but they rarely connect to real business results. A strategic budget forces you to think ahead.

A formal budget gives you the power to:

- Prioritize ruthlessly. Put your money where it actually delivers results instead of spreading it thin across a dozen different channels.

- Measure what matters. Tie every dollar you spend to important metrics like customer acquisition cost (CAC) and return on investment (ROI).

- Plan for the long haul. Build campaigns that gain momentum over time, instead of just chasing quick, short-lived wins.

A marketing budget is your business's permission slip to grow. It dedicates resources specifically to customer acquisition and brand building, ensuring these critical functions don't get lost in day-to-day operational costs.

Setting Realistic Spending Benchmarks

It helps to know what other businesses are spending. While every company is different, the data shows a clear trend: a whopping 78% of small business owners plan to increase their marketing budgets. That tells you just how critical this investment has become.

One great place to start is with high-quality marketing materials, which can make a tangible first impression.

But how do you find the right number for your business? Below are some helpful benchmarks to get you started.

Marketing Budget Benchmarks for Small Businesses

This table provides clear, actionable budget benchmarks based on your business stage and revenue. Use it to find a realistic starting point that aligns with your growth goals.

| Business Stage | Annual Revenue | Recommended Marketing Spend (% of Revenue) | Example Monthly Budget |

|---|---|---|---|

| New Business / Startup | Under $100,000 | 10-15% | $833 - $1,250 |

| Growing Business | $100,000 - $500,000 | 8-12% | $667 - $5,000 |

| Established Business | $500,000 - $1M | 7-10% | $2,917 - $8,333 |

| Scaling Business | Over $1M | 9-12% (or higher for aggressive growth) | $7,500+ |

As you can see, the percentage often shifts based on your immediate goals. A startup in a high-growth phase might push that number higher to capture market share, while an established local business could sit comfortably at the lower end to maintain its position.

Know Your Destination: Defining Marketing Goals Before You Spend a Dime

Throwing money at marketing without a clear target is like driving without a destination—you’ll burn through your cash but never actually get anywhere. The very first rule of building a smart marketing budget is to tie every single dollar to a specific, measurable business outcome. Forget vague wishes like "get more customers." Your budget needs a real job to do.

A purpose-driven budget is built on crystal-clear objectives. Instead of a fuzzy goal, frame it with precision: "Increase website lead conversions by 15% in Q3" or "Grow our local Instagram following with 500 engaged users in the next 60 days." See the difference? These aren't just hopes; they are measurable targets that tell you exactly where your money should go.

This simple shift in thinking turns your budget from a boring list of expenses into a strategic plan for growth.

How Your Goals Dictate Your Spending

The goals you set are the blueprint for your budget allocation. If your primary objective is brand awareness, you'll naturally funnel funds toward things like social media ads and content creation, where you can cast a wide net. On the flip side, a lead generation goal will push you to prioritize SEO and targeted pay-per-click (PPC) campaigns designed to capture people who are ready to buy.

Let's walk through a real-world scenario. Imagine a local bakery that wants to ramp up online orders for custom cakes.

- The Vague Goal: "Sell more cakes." This gives you zero direction. Do you run newspaper ads? Sponsor a local soccer team? It's a guessing game.

- The SMART Goal: "Generate 25 qualified online cake order inquiries per month through our website within four months."

That specific goal immediately brings the strategy into focus. The budget should clearly be allocated to local SEO (so they show up in "bakery near me" searches), targeted Facebook and Instagram ads aimed at users with upcoming birthdays, and high-quality photography to make their cakes look irresistible online. Suddenly, every dollar has a mission.

Your marketing goals are the 'why' behind every dollar you spend. Without them, you're just buying ads and hoping for the best. With them, you're investing in tangible business results, turning your marketing budget into a predictable engine for growth.

Not All Goals Are Created Equal

It's important to recognize that marketing goals fall into a few different buckets. Understanding the difference is critical for allocating your budget wisely. You have to know if you're planting seeds for the future or trying to harvest crops right now.

For instance, a brand-new coffee shop will likely focus on brand awareness first. Their initial budget would be heavy on social media engagement, sponsoring a local farmers' market, and maybe even distributing some eye-catching flyers. They aren't trying to get a direct sale from every dollar just yet; they're trying to become a household name in the neighborhood.

Contrast that with an established e-commerce store whose main goal is customer acquisition. Their budget would be heavily weighted toward Google Shopping ads and retargeting campaigns—tactics with a clear and immediate return on ad spend (ROAS).

Here’s a simple breakdown of common goal types and the channels they typically influence:

Brand Awareness: The main objective is to introduce your brand to people who've never heard of you.

- Channels: Social media campaigns, content marketing (blogs, videos), local sponsorships, and public relations.

Lead Generation: The focus is on capturing contact information from potential customers so you can nurture them over time.

- Channels: Gated content (e-books, webinars), search engine optimization (SEO), targeted paid ads, and email marketing funnels.

Sales Conversion: This goal is all about driving direct purchases or sign-ups. It's the finish line.

- Channels: Pay-per-click (PPC) advertising, retargeting ads, email promotions, and landing page optimization. Many of these efforts are directly tied to achieving measurable sales growth and proving a solid ROI.

Customer Loyalty and Retention: The aim is to turn one-time buyers into repeat customers and brand advocates.

- Channels: Email newsletters, loyalty programs, exclusive customer discounts, and community engagement on social media.

By defining your primary goal first, you can build a budget that is focused and efficient. This ensures you're not wasting money on channels that don’t align with what you need to achieve right now.

How to Calculate a Realistic Marketing Budget

Alright, you've got your goals locked in. Now it's time for the fun part: putting some real numbers behind them. Figuring out your small business marketing budget isn't about pulling a random percentage out of thin air. It’s about creating a concrete plan that lines up with your ambitions and your bank account.

Most businesses take one of two paths here. One is a simple, straightforward method based on what you’re already bringing in. The other is more strategic—it starts with your end goal and works backward to figure out the cost.

Let's walk through both so you can see which one feels right for you.

The Percentage of Revenue Method

This is the most common starting point for a reason: it's simple. You just take your total revenue and dedicate a fixed percentage of it to all your marketing efforts. I like this method because it’s easy to calculate and it scales with you. When business is good, you invest more. When things are tight, your budget adjusts accordingly.

So, what percentage should you use? Industry benchmarks are a great guide:

- Established Businesses (over 5 years): These companies usually put 5-10% of their revenue toward marketing. At this stage, the game is about maintaining your spot and driving steady, predictable growth.

- Startups and Growth-Phase Businesses (under 5 years): If you're newer, you'll likely need to be more aggressive. Think 12-20%. You're trying to build brand recognition from scratch and grab market share, which takes a bigger investment.

Let's say you run a local retail store that's been around for a while, bringing in $300,000 a year. If you decide to allocate 8%, that gives you an annual marketing budget of $24,000. That's $2,000 a month you can consistently plan around.

The Goal-Based (Objective and Task) Method

The percentage model is a solid baseline, but the goal-based approach is where the real strategy comes in. Instead of looking at your revenue, you start with your specific objective and map out exactly what it will cost to get there. This is powerful because it ties every single dollar you spend directly to a result you want.

Let's go back to our bakery that wants to get 25 qualified online cake orders every month.

- What needs to get done? To hit that number, they’ll need to work on their local SEO, run some targeted social media ads, and get some drool-worthy photos of their cakes.

- What will it cost?

- Local SEO Consultant: $500/month

- Facebook/Instagram Ad Spend: $700/month

- One-time Photography Session: $800

- Add it all up: For the first month, their budget would be $2,000 ($500 + $700 + $800). After that, it drops to a recurring $1,200 per month. See the difference? This budget is built to achieve a very specific outcome.

This infographic really drives home how your goals, budget, and actions are all connected.

As you can see, a clear goal is the foundation. It tells you how to build your budget, and that budget then dictates every move you make.

To help you decide which path to take, here's a quick comparison of the two budgeting methods.

Comparing Budget Calculation Methods

| Method | Best For | Pros | Cons |

|---|---|---|---|

| Percentage of Revenue | Businesses seeking simplicity and a stable, predictable budget that scales with performance. | Easy to calculate. Ensures you don't overspend. Naturally adjusts with revenue fluctuations. | Not tied to specific goals. Can be limiting during growth phases. |

| Goal-Based | Businesses with specific, measurable objectives, especially those in a growth phase or launching new products. | Every dollar is tied to an outcome. Highly strategic and focused. Encourages efficient spending. | More complex to calculate. Budget can fluctuate month-to-month. |

Ultimately, many businesses use a hybrid approach—starting with a percentage of revenue as a baseline and then fine-tuning it based on specific, high-priority goals.

Uncovering the Hidden Costs

I've seen so many small business owners make this mistake: they map out their budget, but they only account for the obvious stuff like ad spend. But there are a bunch of "hidden" costs that can totally wreck your plan if you’re not ready for them.

A complete marketing budget isn't just your ad spend. It's the full investment required to run your marketing engine, including the people, tools, and creative assets that make it all happen. Ignoring these leads to an inaccurate picture of your true ROI.

Make sure you're factoring in these often-forgotten expenses:

- Software and Tools: Think about your email marketing service, any social media schedulers, SEO tools, or analytics platforms. These monthly subscriptions add up.

- Creative Assets: Need professional photos for your website? A short video for social media? A graphic designer to create your ads? These are critical and need to be in the budget.

- Talent: Are you paying a freelance copywriter, a virtual assistant to manage your social media, or a specialist to run your Google Ads? Their fees are a core marketing cost.

- Physical Materials: Don't forget about the tangible stuff! If you're a local business, you might need to print flyers, posters, or even some cheap coroplast signs for a local event.

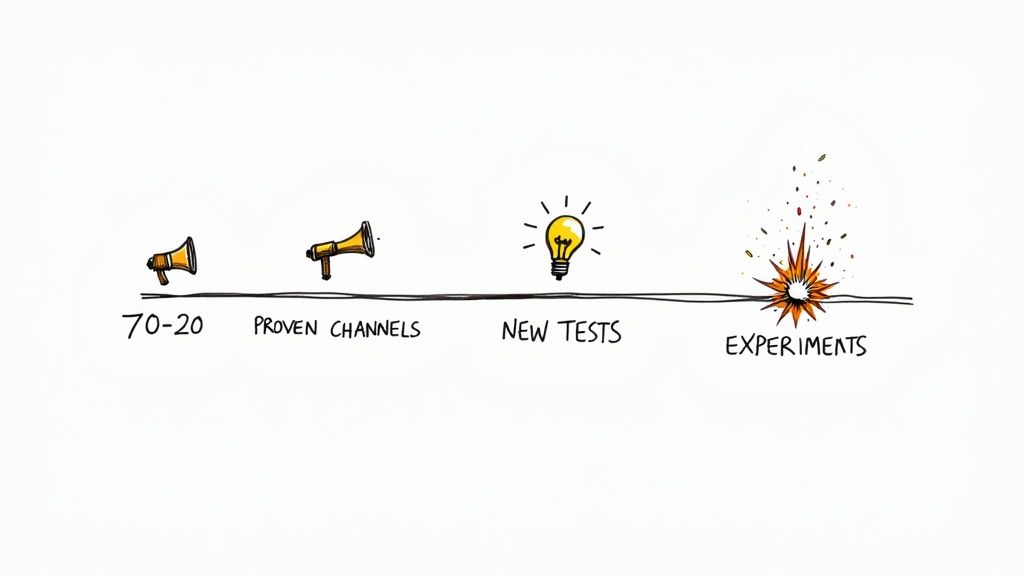

A great framework for allocating your funds is the 70-20-10 rule. Here's how it works: 70% of your budget goes to your proven, bread-and-butter strategies (like Google Ads or email). 20% goes toward exploring new channels that look promising (like trying out TikTok ads). The final 10% is for pure experimentation on things that might be a long shot but could have a huge payoff. This keeps your results steady while still leaving room for innovation.

Allocating Your Budget Across Marketing Channels

Alright, you’ve set your goals and crunched the numbers. Now for the really tactical part: deciding exactly where to put your money. It’s easy to feel pulled in a dozen different directions, with every platform promising the moon.

The key is to allocate your funds with intention. Don't just spray your cash across every channel and hope for the best. A disorganized approach is the fastest way to waste a marketing budget. A solid plan ensures your money is actively working for you, balancing reliable returns with exciting chances for growth.

A Simple Framework: The 70-20-10 Rule

One of the most effective models I’ve seen for budget allocation is the 70-20-10 rule. It's a powerful framework that stops you from putting all your eggs in one basket while protecting your core, revenue-driving activities. It’s all about creating balance.

Here’s the breakdown:

70% on Proven Winners: The bulk of your budget goes right here. These are the tried-and-true channels that consistently deliver results for your business. Think of your finely tuned Google Ads campaigns, your high-performing email funnels, or an established SEO strategy that brings in steady organic traffic.

20% on Promising New Channels: This slice is for scaling what’s working and exploring adjacent opportunities. You might use this to test LinkedIn ads if you're B2B, dabble in influencer collaborations, or expand to a new social platform where your audience is starting to hang out. These are calculated risks based on solid evidence.

10% on Experimental Bets: This is your innovation fund. It's a small part of the budget dedicated to high-risk, high-reward experiments. Maybe you test out a new AI content tool, run a tiny campaign on a brand-new social app, or try an unconventional guerrilla marketing tactic. Most of these will probably fail, but the one that hits could become your next "proven winner."

Making The Rule Work For You

The 70-20-10 rule is just a guideline, not a strict command. Its real power is in its flexibility. A brand-new startup with no "proven winners" might flip the model completely, spending 70% on experiments to find what works. On the other hand, a conservative, established business might shift to an 80-15-5 split.

Let’s look at a real-world example: a local coffee shop with a $2,000 monthly marketing budget.

70% ($1,400) for Proven Winners:

- $700 for local SEO and managing their Google Business Profile to capture "coffee near me" searches.

- $400 for running loyalty promotions through their email newsletter.

- $300 for boosting posts on their established Instagram page.

20% ($400) for Promising Channels:

- They decide to test TikTok by hiring a local creator to produce a few short videos showcasing their specialty drinks, targeting a younger crowd.

10% ($200) for Experiments:

- They use this to sponsor a small neighborhood event or test a new text-based loyalty program to see if it drives more repeat business than email.

This structured approach keeps the lights on while actively exploring new ways to grow. When you're deciding where to invest, looking into effective social media marketing strategies can give you great insight into what’s working for others in your space.

The 70-20-10 rule provides a structured way to balance stability and innovation. It ensures you're consistently investing in what works while still giving yourself permission to discover your next big marketing win.

Blending Digital and Traditional Channels

For a lot of small businesses, marketing isn't just a digital game. Your allocation plan should reflect a smart mix of online and offline tactics, especially if you have a physical location.

The right blend depends entirely on where your customers are. A local plumber might get more value from a branded truck and local sponsorships than from a national TikTok campaign.

Try to integrate your offline efforts with your digital ones. High-quality print collateral, for example, still holds a lot of weight. You can get excellent results by exploring modern direct mail services that use QR codes to drive people to a specific landing page. This simple trick makes a traditionally offline channel trackable, bridging the physical-digital gap.

Here’s a quick look at how different businesses might split their focus:

| Business Type | High-Priority Digital Channels | High-Priority Traditional Channels |

|---|---|---|

| E-commerce Store | SEO, PPC Ads, Social Media Ads, Email Marketing | Product Packaging Inserts, Pop-Up Shops |

| Local Restaurant | Local SEO, Instagram, Email Loyalty Programs | In-Store Menus, Local Event Sponsorships |

| B2B Consultant | LinkedIn, SEO, Webinars, Email Outreach | Networking Events, Industry Conferences |

| Home Services | Google Local Services Ads, Local SEO, Facebook | Branded Vehicles, Door Hangers, Yard Signs |

Ultimately, allocating your marketing budget is an active, ongoing process. By starting with a framework like the 70-20-10 rule and constantly measuring your results, you can build a dynamic financial plan that adapts as your business grows.

Tracking ROI and Optimizing Your Spending

A marketing budget isn't something you create once and then file away. It's a living, breathing tool that should get smarter and more efficient as you learn what works. The only way to make that happen is by diligently tracking your results, understanding what the numbers are telling you, and having the courage to shift your spending based on real-world performance.

Your initial budget is really just your best guess. Tracking your return on investment (ROI) is how you turn that guess into a calculated, data-driven strategy. Without this crucial step, you’re just spending money—not investing it.

The Metrics That Truly Matter

It’s easy to get lost in a sea of analytics. To keep things simple and actionable, I always recommend focusing on just a few key performance indicators (KPIs) that directly tell you if your money is actually working.

For any small business, these are the two most important metrics to live by:

Customer Acquisition Cost (CAC): This is the total cost of convincing someone to become a customer. You calculate it by dividing your total marketing spend by the number of new customers you brought in during that period.

- Formula: Total Marketing Spend / New Customers Acquired = CAC

- Example: If you spent $1,000 on marketing in a month and got 20 new customers, your CAC is $50.

Return on Ad Spend (ROAS): This one is specific to paid advertising and tells you how much revenue you’re generating for every single dollar you spend on ads.

- Formula: Total Revenue from Ads / Total Ad Spend = ROAS

- Example: If you spent $500 on Facebook ads and generated $2,500 in sales, your ROAS is 5x.

These numbers give you a clear, honest picture of your performance. A low CAC and a high ROAS are the vital signs of a healthy marketing engine.

Your budget tells you what you plan to spend, but your ROI tells you what you should spend. Consistently tracking metrics like CAC and ROAS is the only way to close the gap between your plan and reality, ensuring every dollar works as hard as possible.

Simple Tools for Tracking Performance

You don't need a complicated, expensive software suite to monitor your marketing efforts. In fact, you can get started with powerful, user-friendly tools that are probably already at your fingertips.

- Google Analytics: This is non-negotiable for anyone with a website. It shows you where your traffic is coming from, which pages people love, and—most importantly—which channels are actually driving sales or leads.

- Native Social Media Dashboards: Platforms like Facebook, Instagram, and LinkedIn have surprisingly robust built-in analytics. They'll show you the reach, engagement, and conversion data for your posts and ads, all for free.

- A Simple Spreadsheet: Honestly, sometimes the simplest solution is the best. A spreadsheet is perfect for manually tracking your monthly spend per channel and the results you achieved, like leads or total sales.

The goal isn't to track every single click. It's to establish a consistent review process. To make sure your marketing budget is working as hard as possible, explore these powerful conversion rate optimization tips to help turn the traffic you're paying for into actual customers.

Creating a Cycle of Optimization

The real magic happens when you get into a regular review rhythm. Whether it's monthly or quarterly, set aside dedicated time to sit down with your data and make informed decisions. This is the moment you transform from a spender into a strategic investor.

Your review process should answer one simple question: What's working and what isn't?

Once you have your answer, the next step is to act on it. This means systematically shifting funds away from underperforming channels and doubling down on what’s delivering. For instance, if you discover your local SEO efforts are bringing in high-value customers for a low CAC, while your print ads are falling flat, it's time to reallocate those funds.

For businesses focused on a specific geographic area, a strong local marketing strategy often provides a fantastic return and is a great place to invest more of your budget.

This optimization cycle—spend, measure, analyze, adjust—is what makes a small business marketing budget a dynamic tool for growth. With each cycle, your spending gets more efficient, your ROI improves, and your business gets stronger.

Common Questions About Marketing Budgets

When you're figuring out a marketing budget for your small business, a lot of questions pop up. It's a common sticking point for owners. Let's walk through some of the most frequent hurdles and get you some clear, practical answers so you can plan with confidence.

How Much Should a Brand New Business Spend on Marketing?

If you're just starting out, you don't have past revenue to base your budget on, so the popular percentage-of-revenue model won't work. The best approach here is the objective-and-task method.

Start by defining a make-or-break launch goal. Maybe it’s acquiring your first 50 customers. From there, you work backward and price out the specific jobs needed to hit that number. This could mean paying for a local SEO setup, putting a small amount into social media ads, or signing up for email marketing software.

Many startups get their footing with a focused budget of $500 to $2,000 per month. This range is a sweet spot that lets you prioritize high-impact, low-cost strategies—like creating content, networking locally, and building an organic social media presence—while you carefully dip your toes into one or two paid advertising channels.

What Are the Most Cost-Effective Strategies for a Tiny Budget?

When money is tight, you have to get scrappy. The smartest move is to lean into strategies that trade your time and effort for financial outlay. Think of it as "sweat equity" marketing—it builds a powerful foundation you can pour money into later.

Content Marketing and SEO: Writing genuinely helpful blog posts or creating useful guides is a fantastic long-term play. The upfront cost is minimal, but the payoff in brand authority and organic traffic over time can be huge.

Google Business Profile: This is a non-negotiable for any local business. Completely filling out and optimizing your Google Business Profile is free, and it’s one of the highest-impact things you can do to show up in local searches.

Email Marketing: Year after year, email delivers one of the best ROIs in the game. Start building an email list from your very first day in business and focus on nurturing those relationships.

Focused Social Media: Don't try to be everywhere at once. Pick one or two platforms where your ideal customers actually hang out and commit to mastering them. Consistent, valuable engagement costs you nothing but time.

A tiny budget forces you to be resourceful. By focusing on high-leverage, low-cost activities like SEO and email, you can build significant marketing momentum that will pay dividends when you're ready to scale your ad spend.

Should I Include Salaries in My Marketing Budget?

Yes, you absolutely should. A real marketing budget has to account for all related costs, not just your ad spend. If you ignore operational expenses, you’ll get a distorted view of your marketing ROI and set yourself up for some nasty financial surprises down the road.

A complete budget covers everything:

- Salaries for any in-house marketing people.

- Fees for freelancers, consultants, or agencies you hire.

- Monthly subscriptions for all your software and tools (like your email platform or social media scheduler).

A great way to keep this all straight is to divide your budget into three buckets: People (salaries, contractor fees), Tools (software), and Programs (ad spend, campaign costs). This structure gives you a clear, honest picture of your total investment, which is the only way to accurately measure the true return on every dollar you put into growing your business.

Ready to bring your marketing vision to life with materials that make an impact? At 4OVER4, we offer high-quality, affordable printing solutions designed for small businesses. From business cards to banners, get the professional look you need to stand out. Explore our products and start creating today.

More from small business marketing budget

8

Advertising magnets are one of those marketing tools that are so simple, you might overlook their power. They’re tangible, they last for age

Emma Davis

Emma Davis

Jan 30, 2026

14

Tired of fighting with torn paper and sticky residue? We’ve all been there. The best way to get labels off bottles is often a simple soak in

Emma Davis

Emma Davis

Jan 29, 2026

35

Want to know the real secret to getting a poster to stick to a wall without it peeling off in the middle of the night? It's all about what

Emma Davis

Emma Davis

Jan 28, 2026

46

When you hear "table tent specs," what we're really talking about are the foundational details for printing them correctly: the

Emma Davis

Emma Davis

Jan 27, 2026

177

When you're ready to print a poster, one of the first questions you'll face is, "What size should it be?" The industry has a

Emma Davis

Emma Davis

Jan 26, 2026

164

Picture this: you're at a networking event, and someone hands you their business card. You do the usual glance—name, title, company—an

Emma Davis

Emma Davis

Jan 25, 2026

145

Believe it or not, figuring out how to make a card in Word is surprisingly easy. You can knock out everything from slick, professional busines

Emma Davis

Emma Davis

Jan 24, 2026

129

Printing on packaging takes a simple container and turns it into one of your most powerful marketing tools. It’s the very first physical int

Emma Davis

Emma Davis

Jan 23, 2026