- Home

- content hub

- Smart Marketing Budget for Small Business Growth

Smart Marketing Budget for Small Business Growth

Emma Davis

Content Writer

Aug 11, 2025547 views

Aug 11, 2025547 views

Figuring out how much to spend on marketing is one of the most common questions I hear from small business owners. The truth is, there's no single magic number, but there are some solid, experience-backed guidelines that can get you started. A good rule of thumb is to dedicate anywhere from 5% to 15% of your total revenue to your marketing efforts.

Where you fall in that range really depends on your industry and, more importantly, your growth ambitions. If you're an established business simply looking to hold your ground, somewhere around 7-8% is often enough. But if you're aiming for aggressive growth, you'll need to push that closer to 10-14%.

Why a Smart Budget Is Your Growth Engine

Many entrepreneurs flinch at the word "budget." They see it as a restriction, a financial straitjacket designed to limit spending. I get it. But a strategic marketing budget is the exact opposite. Think of it less as a set of rules and more as a roadmap for intentional growth.

A well-crafted budget transforms marketing from an unpredictable, anxiety-inducing expense into a reliable revenue driver. It gives you the power to make clear-headed decisions, ensuring every dollar you spend is working toward a specific, measurable goal.

The Tale of Two Businesses

Let's look at a real-world scenario to see why this matters.

Imagine a local bakery that runs its marketing on impulse. When sales dip, they might throw some money at a boosted social media post or panic-buy a last-minute ad in the community newspaper. There’s no real plan. Their marketing is sporadic, their message is all over the place, and at the end of the month, they have no clue what actually brought customers through the door. The result? A messy mix of low-quality leads and wasted cash.

Now, picture a second bakery that operates with a structured marketing budget. They’ve intentionally allocated funds to grow their email list with a lead magnet, run targeted local ads for their seasonal specials, and invest in high-quality printed materials for in-store promotions. Because they have a plan, they can track which activities generate the most foot traffic and online orders. This bakery isn't just spending money; they're investing in predictable outcomes and building a foundation for sustainable growth.

A well-planned budget turns marketing from a guessing game into a calculated strategy. It provides the clarity needed to connect spending directly to business objectives, fostering consistent brand presence and higher-quality customer engagement.

From Cost Center to Revenue Driver

This shift in mindset is everything. Without a budget, marketing always feels like a cost center—a necessary evil that just drains your bank account. With a budget, it becomes a powerful growth engine. You can allocate funds with confidence because you have a plan to measure the return, whether that’s more website traffic, better leads, or a direct bump in sales.

This proactive approach gives you the ability to:

- Prioritize effectively by putting your money where it has the best chance of delivering a return.

- Maintain consistency in your marketing, which is crucial for building brand recognition and trust over time.

- Measure success accurately, so you can double down on what works and cut what doesn't.

- Plan for the future by setting aside funds for new opportunities or to test a new channel.

Setting Your Initial Spending Benchmark

So, how much should you actually set aside? The most straightforward method is basing it on a percentage of your revenue. In 2025, the 5% to 15% rule is still a very reliable benchmark for small businesses. Data from the U.S. Small Business Administration backs this up, showing that companies with under $5 million in revenue often spend 7-8% just to maintain their current market position.

If you have more ambitious goals, you'll need to invest more. Pushing that figure up to the 10-14% range is often what it takes to drive significant sales growth. For a deeper dive into how these marketing costs break down in today's market, you can find some great insights over at Pronto Marketing.

To make this even simpler, here’s a quick guide to help you align your spending with your business goals.

Quick Guide to Setting Your Marketing Budget Percentage

This table offers a simple framework to help you decide on a starting percentage based on where your business is and where you want it to go.

| Business Goal | Recommended Percentage of Revenue | Primary Focus |

|---|---|---|

| Maintain Position | 6% - 9% | Brand awareness, customer retention, stable lead flow. |

| Steady Growth | 10% - 14% | New customer acquisition, market share expansion. |

| Aggressive Growth | 15% + | Rapid scaling, entering new markets, launching products. |

Using this framework helps connect your financial commitment directly to your strategic ambitions. By understanding these benchmarks, you can build a marketing budget that not only supports your day-to-day operations but also paves the way for a much brighter future. A thoughtful budget isn't a limitation; it's one of the most powerful tools you have.

Before you even think about numbers, you have to get your head straight about what you're actually trying to accomplish. So many small business owners jump straight to "How much should I spend?" without first asking, "What's the goal?" That's a surefire way to burn through cash and end up right where you started.

Think of this initial planning not as a chore, but as building the compass that will guide every dollar you spend. It’s what turns your budget from a list of expenses into a real engine for growth.

First things first: you need to trade vague wishes for rock-solid goals. "I want more sales" isn't a goal; it’s a dream. A real goal has teeth. It’s specific, measurable, and gives you a clear target to aim for.

For instance, a local bakery looking to grow might set a goal to "increase online cake orders by 20% in the next quarter." Or a new consultant might aim to "generate 15 qualified leads per month through LinkedIn." See the difference? These goals give your budget a clear job to do and a benchmark for success.

Get a Feel for Your Sales Cycle

Next, you need to understand how long it takes for a stranger to become a customer. This is your sales cycle, and it dictates your marketing rhythm.

A business selling quirky t-shirts online might have a super short cycle—someone sees an ad on Instagram, clicks, and buys within minutes. It’s an impulse-driven world.

But what about a local roofer? That’s a whole different ball game. A homeowner might notice a leak, spend weeks researching companies, get a few different quotes, and then finally make a decision. That much longer cycle means your marketing needs to have staying power. You can't just rely on a single ad. You'll need to support multiple touchpoints over time, from a helpful blog post about shingle types to old-school business cards and flyers from a business basics collection that keep your name top-of-mind.

Figure Out What a Customer Is Really Worth

Not every customer brings the same value to your business. Knowing your Customer Lifetime Value (CLV) is the secret to figuring out how much you can sanely spend to get a new one. In simple terms, CLV is the total profit you can expect from a single customer over their entire relationship with you.

A quick way to estimate CLV: (Average Sale Amount) x (How Often They Buy Per Year) x (How Many Years They Stick Around)

Let’s use the roofer example. If their average re-roofing job is $8,000 and a happy customer refers them to a neighbor just once within a five-year lifespan, their CLV could be much higher than that initial job. If a customer also signs up for a $250 annual gutter cleaning service for five years, that adds another $1,250. Suddenly, spending $500 on targeted local ads to acquire that homeowner looks like a brilliant investment.

This one number helps you stop guessing and start making smart decisions about where to put your money. Before you get too deep in the marketing weeds, though, it’s wise to get your overall finances in order. This guide on budgeting for small business success is a great place to start for building that solid financial foundation.

Walk in Your Customer's Shoes

Finally, take a moment to map out the typical path someone takes to find you. This customer journey is a roadmap of their experience with your brand, from the first "Aha!" moment to the final handshake or click to buy.

Put yourself in their mindset at each stage:

- Awareness: They just realized they have a problem. They might be Googling things like, "why does my basement smell musty?"

- Consideration: Now they're exploring solutions. Their searches get more specific, like "best basement waterproofing companies near me."

- Decision: They're ready to pull the trigger. They’re looking for social proof—reviews, testimonials, or a compelling offer that seals the deal.

When you map this out, you can strategically allocate your budget to meet them where they are. You'll know to put some money into helpful blog content (Awareness), some into local SEO (Consideration), and some into targeted ads with a "Request a Free Estimate" button (Decision). It’s how you make sure you’re showing up with the right message at the perfect time, making every single dollar work as hard as you do.

How to Build Your Budget From Scratch

Alright, let's get down to business—actually putting your marketing budget together. This isn't about plucking a random number out of the air. It’s about being methodical to create a plan that's both realistic and powerful enough to fuel real growth. In my experience, there are two tried-and-true ways to do this: the top-down approach and the bottom-up approach.

The Top-Down Approach: A Simple Starting Point

The top-down method is probably the most straightforward way to get a number on the page. You simply take a percentage of your total business revenue (or your projected revenue) and earmark it for marketing.

As we touched on earlier, a common rule of thumb is 5% to 15%. This approach is popular for a reason: it’s easy to calculate and helps ensure your spending doesn't get out of sync with your company’s financial reality.

For instance, a small e-commerce shop doing $250,000 in annual revenue might decide to set aside 8% for marketing. That gives them a clear annual budget of $20,000, which breaks down to about $1,667 a month. The big advantage here is the financial safety net—you won't overspend because your budget is tied directly to your income. The flip side, however, is that this method doesn't really account for your specific goals or what it actually costs to achieve them.

The Bottom-Up Approach: Building on Your Goals

This is where things get more strategic. With a bottom-up approach, you start with your business goals and work backward to figure out what it will cost to hit them. It forces you to get crystal clear on what you want to accomplish and which marketing plays will get you there.

Let's walk through a real-world scenario. Imagine a local HVAC company wants to land 30 new installation contracts next quarter. Looking at their past data, they know two things: their website turns 5% of visitors into leads, and their sales team closes 20% of those leads.

Here’s how they’d do the math:

- First, calculate the leads needed. To get 30 contracts, they need 150 qualified leads (30 contracts / 0.20 close rate).

- Next, determine the website traffic required. To get 150 leads, they’ll need 3,000 website visitors (150 leads / 0.05 conversion rate).

- Finally, figure out the cost. If their average cost-per-click (CPC) on local Google ads is $4, then the required ad spend is $12,000 (3,000 visitors x $4 CPC).

Boom. That $12,000 becomes their quarterly advertising budget, and it’s directly tied to a specific, measurable outcome.

The bottom-up method connects every dollar to a specific objective. While it requires more initial research and planning, it creates a much more powerful and accountable marketing budget for a small business.

Making this kind of strategic choice is more important than ever. The small business world is crowded, with around 400 million small and medium-sized enterprises (SMEs) operating globally as of 2024-2025. This competition makes smart budgeting non-negotiable. We're even seeing budgets shift to newer channels; in the US, for example, podcast ad spend is projected to hit $2.38 billion in 2025, an 18.5% jump from 2023. You can dig into more of these small business marketing stats over at ThriveThemes.com.

Itemizing Your Common Marketing Expenses

No matter which approach you lean toward, you still need to know where the money is actually going. Here are some of the most common buckets you’ll be filling:

- Digital Advertising: This is your pay-per-click (PPC) spend on platforms like Google and Bing, plus social media ads on Facebook, Instagram, LinkedIn, or TikTok.

- Content Creation: Don't just think blog posts. This covers everything from graphic design and video production to professional photography and hiring freelance writers.

- SEO (Search Engine Optimization): This might be your retainer for an agency or freelancer, or the cost of essential tools for keyword research and rank tracking.

- Software and Tools: Your "tech stack" is a real expense. Think about your email marketing service, CRM, social media schedulers, and analytics platforms.

- Printed Marketing Materials: Never underestimate the power of tangible marketing. This includes everything from business cards and brochures to trade show banners and direct mail. Finding a reliable partner for your marketing essentials is key for quality and consistency.

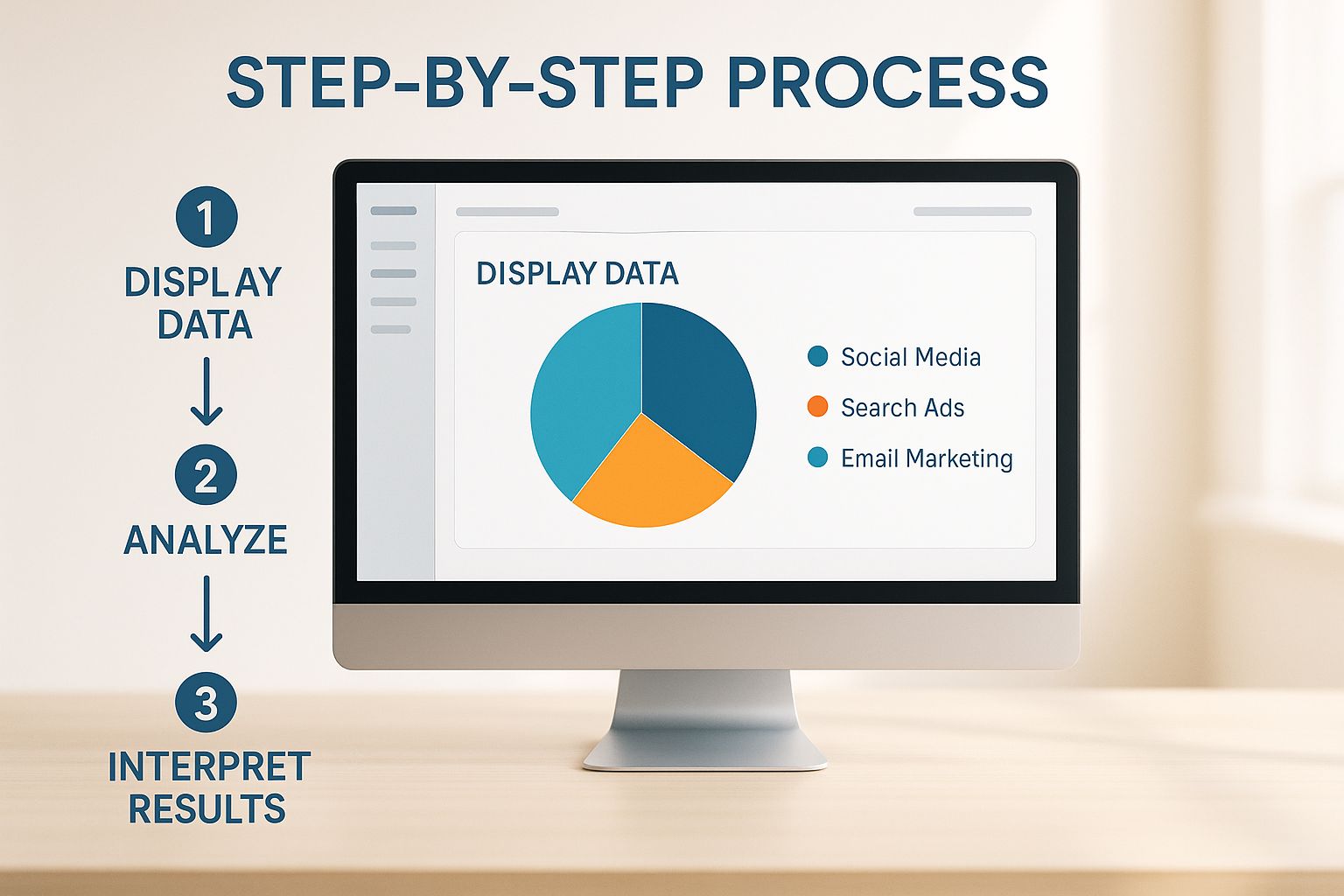

Here’s a look at how a sample budget might be split across different digital channels.

This visual shows how a business might prioritize its spend to match its goals—putting a good chunk toward high-intent channels like search ads while still investing in audience-building on social media and email.

From what I’ve seen, the most successful small businesses often use a hybrid approach. They start with the top-down method to set a reasonable overall spending cap, then use the bottom-up method to allocate those funds strategically against their most important objectives. It’s the best of both worlds.

Slicing the Pie: Where to Spend Your Marketing Dollars for the Best Return

You've got your number. Now for the fun part—deciding exactly where to put that money to work. This is where your strategy truly comes alive. It's less about sterile accounting and more about making smart, informed bets based on what you know about your customers and your ultimate business goals.

The biggest mistake I see small businesses make is spreading their budget too thin, trying to be everywhere at once. Don't fall into that trap. The key is to focus your dollars on the channels that directly map to your sales process. If you run a local service business that needs qualified leads, pouring your limited funds into a massive brand awareness campaign on a platform with no clear conversion path is a recipe for a drained bank account.

The 70-20-10 Rule: A Smarter Way to Allocate

A brilliant framework I always recommend for balancing reliable results with future growth is the 70-20-10 rule. It’s a simple but incredibly effective way to structure your spending. It protects your core business while still giving you room to innovate.

Here’s how it works:

70% on What’s Working Right Now: This is the lion's share of your budget. It goes straight to the tried-and-true channels that consistently deliver results. For a local bakery, this could be Google Ads targeting "birthday cakes near me" or a well-oiled local SEO strategy. This is your bread and butter.

20% on Promising New Channels: Dedicate this slice to opportunities that are showing potential but aren't quite a sure thing yet. Maybe you've seen a competitor getting great traction with Instagram Reels, or your own initial tests on a new platform looked promising. This is where you invest to see if you can scale those early wins.

10% on Pure Experiments: Think of this as your marketing R&D lab. It's a small, controlled fund for trying completely new, sometimes off-the-wall ideas. You might test a new ad format, sponsor a tiny niche podcast, or jump on a brand-new social app before anyone else.

This model gives you a built-in safety net. You’re securing your current revenue with the 70%, pushing for new growth with the 20%, and protecting your future with the 10%.

How This Looks in the Real World

Let's make this concrete. Imagine an online store selling handcrafted leather wallets has a monthly marketing budget of $5,000. Here’s how they could apply the 70-20-10 rule:

70% ($3,500) for Proven Winners: Their Google Shopping ads and email marketing to past customers are their most consistent sales drivers. This money gets pumped right back into scaling these campaigns to maximize immediate revenue. It just works.

20% ($1,000) for Emerging Opportunities: They’ve noticed their behind-the-scenes videos showing the leatherwork process get great organic engagement on TikTok. They’ll use this $1,000 to run a structured TikTok influencer campaign to see if they can turn that buzz into actual sales.

10% ($500) for Experimental Bets: They have a hunch that Pinterest could be a great fit for their visually appealing products, but they've never tried it. This $500 lets them run a test campaign, gather data, and see if it's worth investing more in later—all without risking the core budget.

This strategic split stops you from putting all your eggs in one basket. It ensures that while you're milking what works today, you're also actively hunting for what's going to work tomorrow.

This forward-thinking mindset is more important than ever. After a period of uncertainty, businesses are reinvesting in marketing. A net 21.7% of UK companies boosted their marketing budgets in late 2024, with spending on events and direct marketing seeing a big jump. Over in the US, 63% of small businesses are planning to increase their marketing spend, showing a renewed confidence in marketing as a critical growth engine. You can dig into more of these insights on current marketing spend to see where the money is flowing.

Even if your strategy is heavily digital, never underestimate the power of something real. Setting aside a small part of your budget for high-quality printed marketing materials can be a game-changer. Think of premium postcards for trade shows, flyers for local community boards, or branded inserts that make your packages unforgettable. They create a physical connection that a digital ad simply can't.

How to Track and Optimize Your Budget

Alright, you’ve created a marketing budget. That’s a huge step, but don't file it away just yet. The biggest mistake I see small business owners make is treating their budget as a static, one-and-done document.

Think of your budget as a living, breathing part of your strategy. It needs regular check-ups to stay healthy and effective. This is where the real magic happens—turning raw data into smart, decisive action. It’s how you spot an underperforming channel before it drains your funds and double down on a surprise winner that’s quietly delivering results.

Setting Up Your Tracking System

You don't need a fancy, expensive software suite to get started. Honestly, a well-organized spreadsheet is more than enough for most small businesses and is often the best place to begin.

Start simple. Create a sheet with columns for each marketing channel (like Google Ads, Facebook, Email), the amount you budgeted, what you actually spent, and the results you got. This gives you a clear, at-a-glance dashboard. If you want a deeper dive, this guide on how to track business expenses has some great, practical tips.

Once you’re comfortable, you can level up by integrating free tools like Google Analytics. By setting up goals in Analytics, you can automatically track website conversions, showing you precisely which channels are bringing in leads or sales. This automates a lot of the grunt work and gives you much richer data to play with.

The point of tracking isn't just to watch numbers. It's about gathering the intelligence you need to make smarter marketing investments next month and next quarter.

Key Metrics You Need to Watch

It’s easy to get buried in data. My advice? Ignore the noise and focus on a handful of Key Performance Indicators (KPIs) that truly matter to your bottom line. The right ones will depend on your specific goals.

If your goal is generating leads:

- Cost Per Lead (CPL): This is your total marketing spend divided by the number of new leads. It’s a straightforward metric that tells you exactly what it costs to get someone to raise their hand.

- Conversion Rate: This is the percentage of people who take the action you want, like filling out a contact form. A low conversion rate might mean your landing page needs work, not necessarily the ad that sent them there.

If you’re running an e-commerce or direct sales business:

- Return on Ad Spend (ROAS): This is the holy grail. It measures the revenue you earn for every dollar you spend on ads. A 4:1 ROAS is a common benchmark, meaning you make $4 for every $1 you put in.

- Customer Acquisition Cost (CAC): This is your total cost to land a single new customer. It’s a bigger-picture metric than CPL and is absolutely vital for understanding your overall profitability.

These KPIs tell a story. For instance, if your CAC on Facebook ads is $50, but your average customer only spends $35 on their first purchase, you know that channel isn't profitable right out of the gate and needs a serious rethink.

Turning Insights Into Action

Data is useless if you don't act on it. Your monthly or quarterly budget reviews are your opportunity to be the CEO of your marketing.

Pull up your tracking sheet and ask the tough questions. Is the money spent on that trendy promotional products giveaway actually bringing in loyal customers, or just attracting freebie-seekers? Are those blog posts you’re spending hours on generating organic traffic that converts?

Based on what you find, make adjustments. This is optimization in action. It could mean pausing a Google Ads campaign that isn’t working and moving that $500/month to boost your best-performing Instagram posts. Or it might mean doubling your budget for an email campaign that’s crushing its ROAS goals. This constant cycle of reviewing, learning, and reallocating is what turns a simple budget into a powerful engine for sustainable growth.

Answering Your Top Small Business Budget Questions

Even with the best-laid plans, things get messy in the real world. Reading about budget theory is one thing, but it's a completely different ball game when you're staring at your actual bank account, trying to make it all work. Let's tackle some of the most common questions and hurdles small business owners face.

Think of this as your practical field guide. I'll give you direct, no-fluff answers to help you navigate those tricky situations and get confident with your marketing spending.

What Should I Do If I Have Almost No Marketing Budget?

First off, don't panic. Starting with next to nothing in the bank for marketing is incredibly common. The trick is to shift your mindset from spending money to investing your time. It’s all about "sweat equity." Your main goal right now is to build a solid foundation so that when you do have money to spend, every dollar will go further.

Your first move? Create and meticulously optimize your Google Business Profile. It’s totally free and is an absolute powerhouse for getting found locally. Fill out every single section, upload quality photos, create posts, list all your services, and make a habit of asking customers for reviews.

Next, pour your effort into content. Start a simple blog on your website that directly answers the top 5-10 questions you hear from customers all the time. This costs you nothing but your time and immediately starts building long-term SEO value.

With a shoestring budget, your strategy shifts from paid advertising to organic community building and content creation. The assets you build now—like an email list or a high-ranking blog post—will become your most valuable marketing tools down the road.

Finally, pick just one or two social media platforms where you know your ideal customers hang out. Don't just broadcast promotions. Instead, focus on jumping into conversations and building a small but fiercely loyal community.

How Often Should I Review and Adjust My Budget?

A marketing budget can't be a "set it and forget it" document. To do this right, you need a consistent review rhythm. I find it’s best to think of it in two distinct cadences.

You should be doing a light review monthly. This is your tactical check-in. Take a quick look at your core metrics. Are your ad campaigns hitting their targets? Is a particular social media channel eating up time with zero results? This monthly glance lets you make small, smart adjustments, like moving a few hundred dollars from an underperforming ad set to one that’s crushing it.

Then, you need to conduct a deep-dive review quarterly. This is your strategic overhaul. Here, you zoom out and look at the bigger picture. Did you actually hit your main goals for the last three months? Have market conditions shifted? This is when you make bigger calls, like pausing an entire channel that just isn’t delivering and reallocating that budget to test a new one for the next 90 days. And, of course, a major planning session should happen annually to set the stage for the year ahead.

What Are Some Common Hidden Costs in a Marketing Budget?

It’s pretty easy to budget for the obvious line items like ad spend. But I’ve seen too many businesses get blindsided by the costs lurking just beneath the surface. Forgetting these can quickly derail an otherwise solid marketing budget for a small business.

Be sure to account for these common hidden costs:

- Creative Production: This isn't just for big corporations. It’s the subscription to a stock photo service like Adobe Stock, the fee for simple video editing software, or the cost of hiring a designer on Fiverr to create your social media graphics.

- Software and Tools: Your marketing technology has real costs that add up fast. We’re talking about your email marketing platform like Mailchimp, your social media scheduler, SEO software like Ahrefs, or your CRM. Those monthly fees are a significant expense.

- Contingency Fund: This is absolutely essential. I always recommend setting aside 10-15% of your total budget as a contingency. This isn't just "extra" cash; it's a strategic fund for jumping on unexpected opportunities (like a last-minute event sponsorship) or for doubling down on a campaign that suddenly takes off.

- Human Resources: Whether you hire a freelancer for a specific project, put an agency on retainer, or bring on a part-time marketing assistant, their cost is a major line item. And even if it's just you, remember to factor in the value of your own time.

At 4OVER4, we know that bringing your marketing vision to life requires high-quality, reliable printing. From business cards that make a great first impression to eye-catching banners for your next event, we provide the tools you need to support your marketing strategy. Explore our full range of professional printing solutions.

More from marketing budget for small business

9

Staring at a wall of banner dimensions can feel a little overwhelming. But while there's no single "typical banner size" that wo

Emma Davis

Emma Davis

Feb 1, 2026

18

Stretching your marketing budget doesn't mean you have to settle for flimsy, forgettable brochures. The real secret to low cost br

Emma Davis

Emma Davis

Jan 31, 2026

34

Advertising magnets are one of those marketing tools that are so simple, you might overlook their power. They’re tangible, they last for age

Emma Davis

Emma Davis

Jan 30, 2026

36

Tired of fighting with torn paper and sticky residue? We’ve all been there. The best way to get labels off bottles is often a simple soak in

Emma Davis

Emma Davis

Jan 29, 2026

99

Want to know the real secret to getting a poster to stick to a wall without it peeling off in the middle of the night? It's all about what

Emma Davis

Emma Davis

Jan 28, 2026

84

When you hear "table tent specs," what we're really talking about are the foundational details for printing them correctly: the

Emma Davis

Emma Davis

Jan 27, 2026

284

When you're ready to print a poster, one of the first questions you'll face is, "What size should it be?" The industry has a

Emma Davis

Emma Davis

Jan 26, 2026

192

Picture this: you're at a networking event, and someone hands you their business card. You do the usual glance—name, title, company—an

Emma Davis

Emma Davis

Jan 25, 2026